Hey there! I wanted to share some useful information with you regarding W-8 and W-9 forms. These forms are essential when it comes to managing your taxes and providing accurate information to the Internal Revenue Service (IRS). So, let’s dive right in!

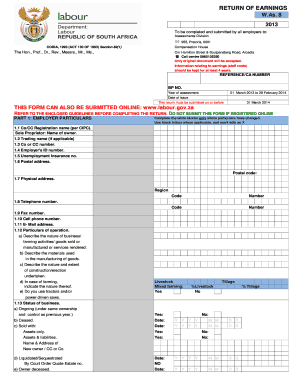

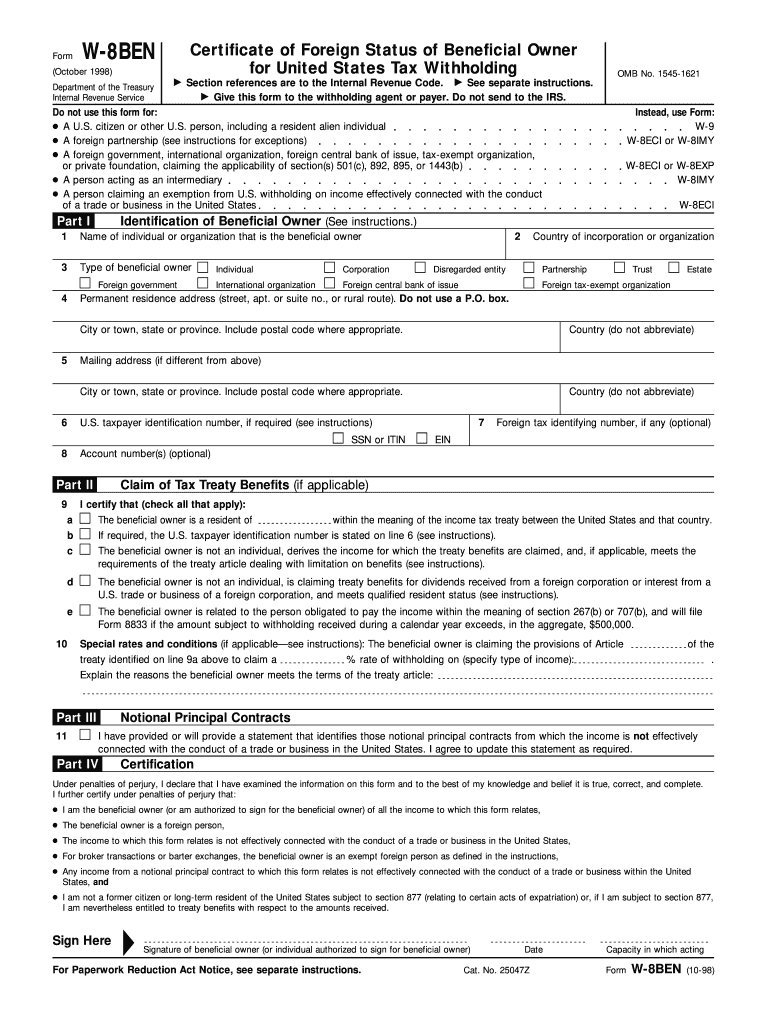

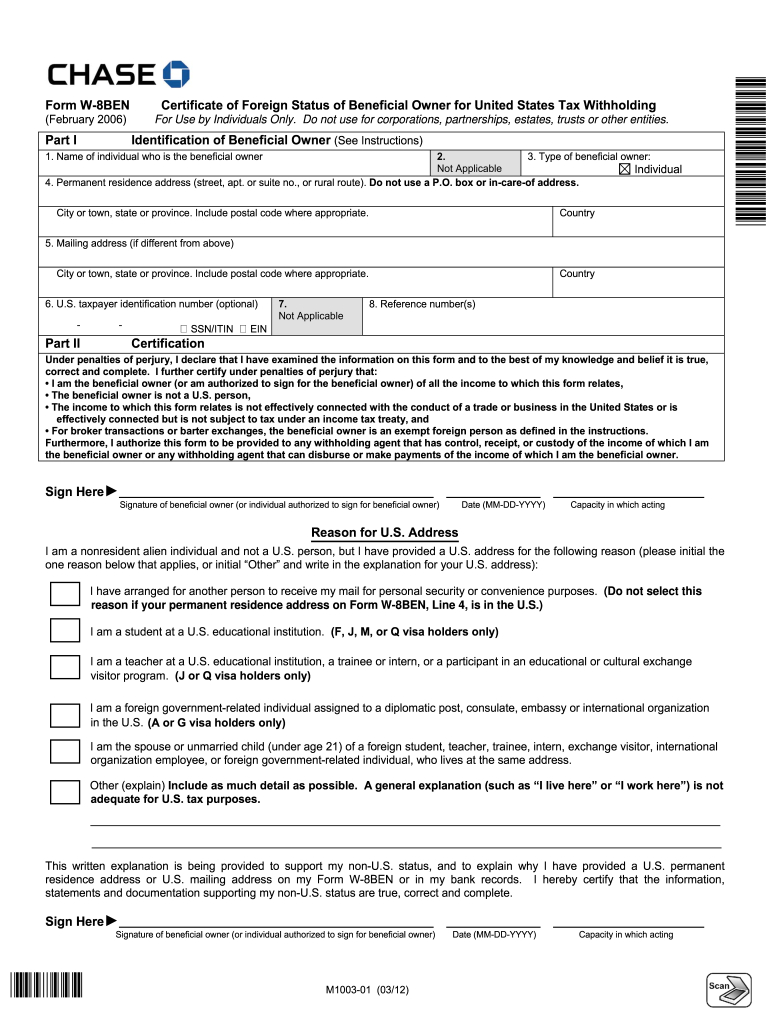

Printable W-8 Forms and Templates

When you need to report your foreign status to the IRS, the W-8 form is what you would fill out. This form ensures that you correctly declare your non-U.S. citizen or non-U.S. resident alien status. By doing so, you can either receive income without taxation or have a reduced tax rate, depending on the purpose of the payment.

When you need to report your foreign status to the IRS, the W-8 form is what you would fill out. This form ensures that you correctly declare your non-U.S. citizen or non-U.S. resident alien status. By doing so, you can either receive income without taxation or have a reduced tax rate, depending on the purpose of the payment.

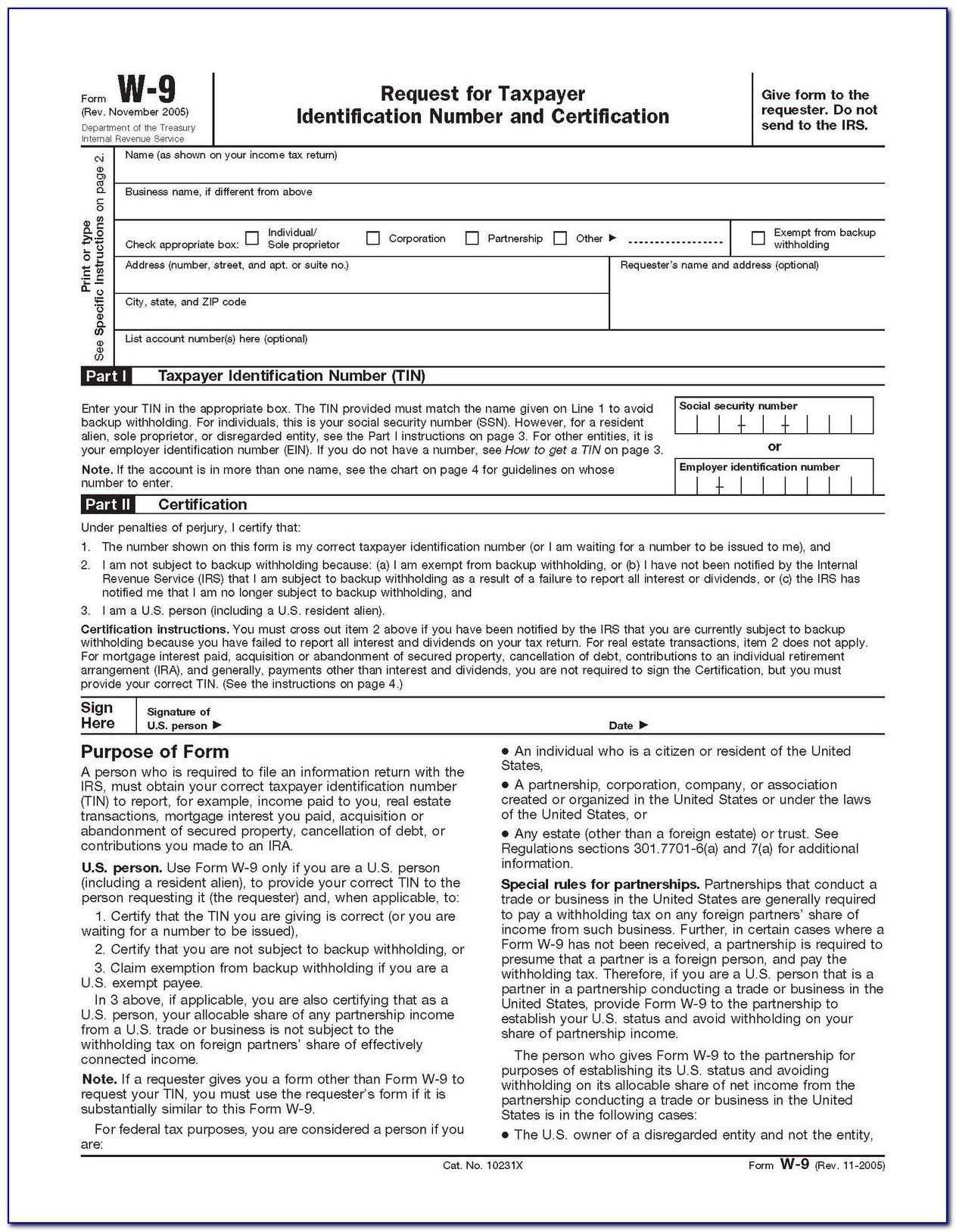

Blank W-9 Forms Printable

On the other hand, the W-9 form is used for U.S. citizens or U.S. resident aliens to provide their taxpayer identification number (TIN) to the person or business who is requesting it. This form ensures that the correct information is provided for tax reporting purposes.

On the other hand, the W-9 form is used for U.S. citizens or U.S. resident aliens to provide their taxpayer identification number (TIN) to the person or business who is requesting it. This form ensures that the correct information is provided for tax reporting purposes.

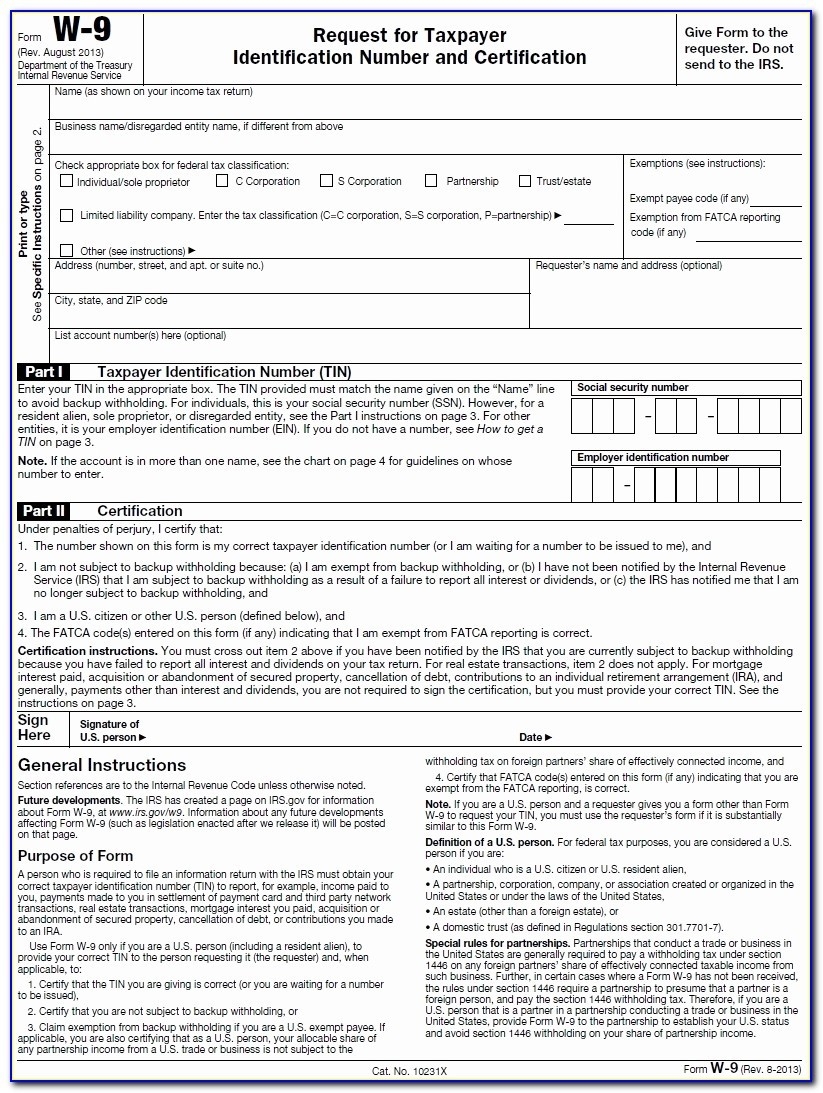

Blank W-9 Form 2020 Printable

If you are a business owner who needs to hire independent contractors or freelancers, you will often request them to fill out a W-9 form. This allows you to accurately report their earnings to the IRS.

If you are a business owner who needs to hire independent contractors or freelancers, you will often request them to fill out a W-9 form. This allows you to accurately report their earnings to the IRS.

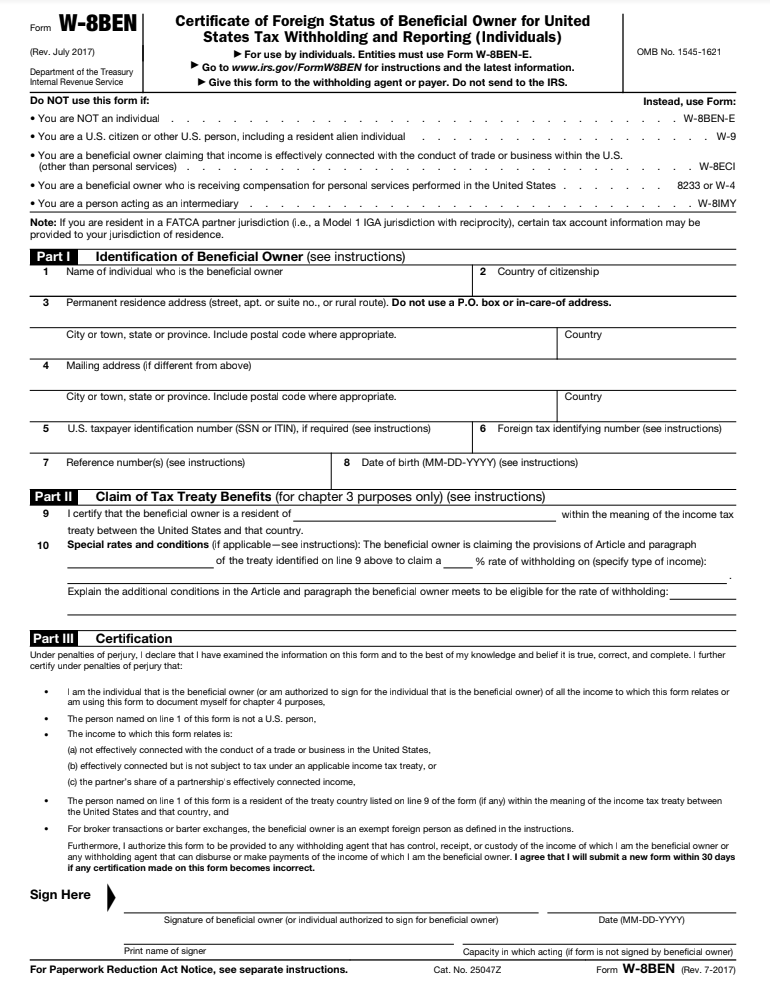

W-8 and W-9 Form Samples

If you are unsure how to fill out these forms correctly, fret not! You can easily find printable templates online that provide step-by-step instructions on how to complete them accurately.

If you are unsure how to fill out these forms correctly, fret not! You can easily find printable templates online that provide step-by-step instructions on how to complete them accurately.

Irs Form W8 Printable

These printable IRS forms make it convenient for you to provide the necessary information, ensuring smooth and seamless tax compliance.

These printable IRS forms make it convenient for you to provide the necessary information, ensuring smooth and seamless tax compliance.

Conclusion

Remember, it is crucial to understand the purpose of each form and fill them out accurately. These forms not only help you comply with tax regulations but also ensure that you are receiving appropriate tax treatment.

Always keep a copy of the completed forms for your records, as they may come in handy during tax season or when filing your tax returns.

That’s all for now! Make sure to keep these forms handy and consult a tax professional if you have any doubts or questions. Stay on top of your tax obligations, and you’ll smoothly navigate the complex world of taxes!