As we approach the new year, it’s important for all individuals to familiarize themselves with various tax forms and documents. One such form that often comes into play is the W-4 form. This form is used by employees to indicate their tax withholding preferences to their employers. Understanding and correctly filling out the W-4 form is crucial to ensure accurate tax withholding throughout the year.

W2 Forms 2020 Printable - 2022 W4 Form

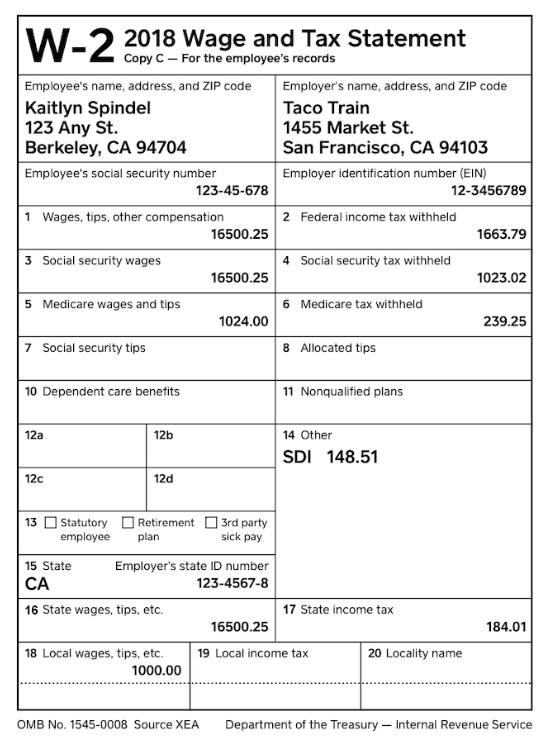

Let’s start with an informative resource that provides printable W-2 forms for the year 2020. These forms are an essential component of the tax filing process for employees. Having a printable version of the W-2 form can be incredibly convenient, especially if you prefer filling it out manually.

Let’s start with an informative resource that provides printable W-2 forms for the year 2020. These forms are an essential component of the tax filing process for employees. Having a printable version of the W-2 form can be incredibly convenient, especially if you prefer filling it out manually.

Blank W4 Form Online | eSign Genie

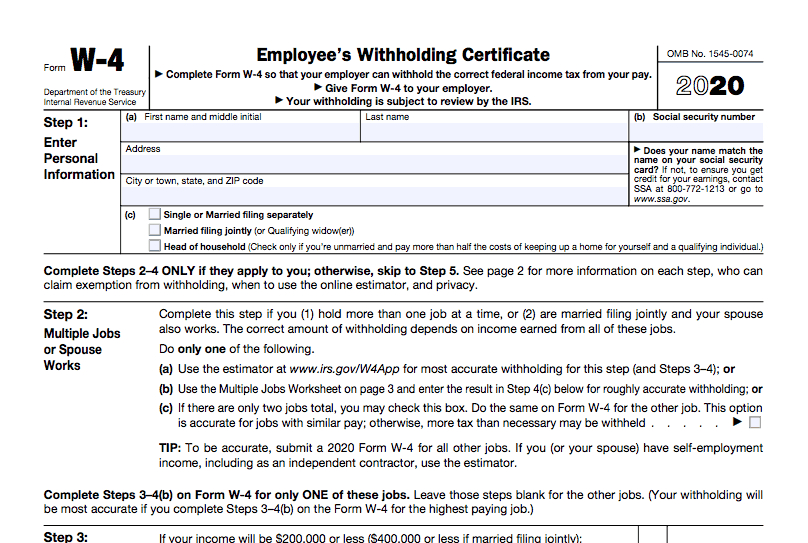

If you’re looking for a blank W-4 form that you can fill out electronically, eSign Genie offers a user-friendly online platform. With this tool, you can easily input your information and electronically sign the W-4 form. This saves time and eliminates the need for printing physical copies.

If you’re looking for a blank W-4 form that you can fill out electronically, eSign Genie offers a user-friendly online platform. With this tool, you can easily input your information and electronically sign the W-4 form. This saves time and eliminates the need for printing physical copies.

Free 2021 W 2 Form To Print | Calendar Template Printable

If you’re in search of a printable version of the W-2 form for the year 2021, Calendar Template Printable provides a free option. This allows you to have a physical copy of the form readily available, making it easier to reference and complete your tax filing process.

If you’re in search of a printable version of the W-2 form for the year 2021, Calendar Template Printable provides a free option. This allows you to have a physical copy of the form readily available, making it easier to reference and complete your tax filing process.

Printable W4 Form

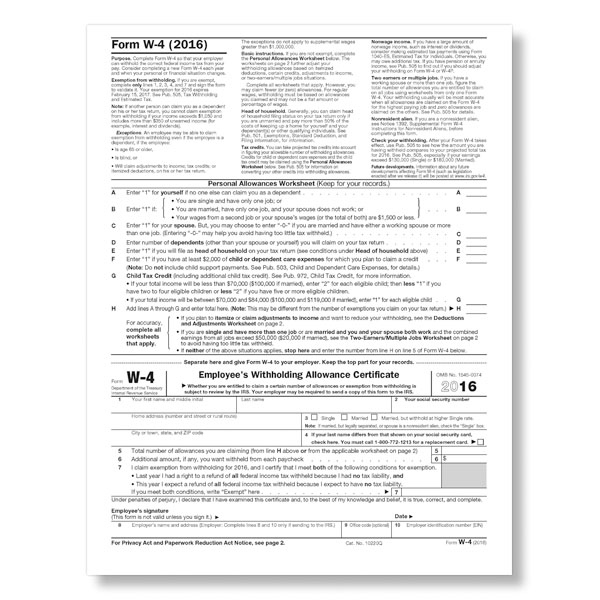

For those who prefer a printable version of the W-4 form, there is a resource available that offers just that. By having a physical copy, you can take your time to fill out the form accurately, double-checking all the information you provide.

For those who prefer a printable version of the W-4 form, there is a resource available that offers just that. By having a physical copy, you can take your time to fill out the form accurately, double-checking all the information you provide.

Printable W 4 Form Payroll - 2022 W4 Form

Employers often require employees to fill out the W-4 form as part of the payroll process. This printable version of the W-4 form for payroll purposes allows employees to provide their tax withholding preferences accurately, ensuring that the correct amount is deducted from their paychecks.

Employers often require employees to fill out the W-4 form as part of the payroll process. This printable version of the W-4 form for payroll purposes allows employees to provide their tax withholding preferences accurately, ensuring that the correct amount is deducted from their paychecks.

2019 W4 Form: How To Fill It Out and What You Need to Know

Although we have moved on to newer versions of the W-4 form, it can still be beneficial to understand how the 2019 version works. This comprehensive guide provides step-by-step instructions on how to fill out the 2019 W-4 form correctly, as well as important information to keep in mind.

Although we have moved on to newer versions of the W-4 form, it can still be beneficial to understand how the 2019 version works. This comprehensive guide provides step-by-step instructions on how to fill out the 2019 W-4 form correctly, as well as important information to keep in mind.

2022 Form W-4 - IRS Tax Forms - W4 Form 2022 Printable

Looking ahead, it’s essential to familiarize yourself with the 2022 version of the W-4 form. The IRS Tax Forms website offers a printable version of the 2022 Form W-4, which will be crucial for employees in the upcoming year.

Looking ahead, it’s essential to familiarize yourself with the 2022 version of the W-4 form. The IRS Tax Forms website offers a printable version of the 2022 Form W-4, which will be crucial for employees in the upcoming year.

Printable W4 Form For Employees Free - FREE PRINTABLE TEMPLATES

Employees who prefer having a physical copy of the W-4 form can access a printable version for free. This resource provides employees with easy access to a printable W-4 form, making it convenient to complete the necessary tax documentation.

Employees who prefer having a physical copy of the W-4 form can access a printable version for free. This resource provides employees with easy access to a printable W-4 form, making it convenient to complete the necessary tax documentation.

New Form W-4: What Employers Need to Know - Dembo Jones Certified

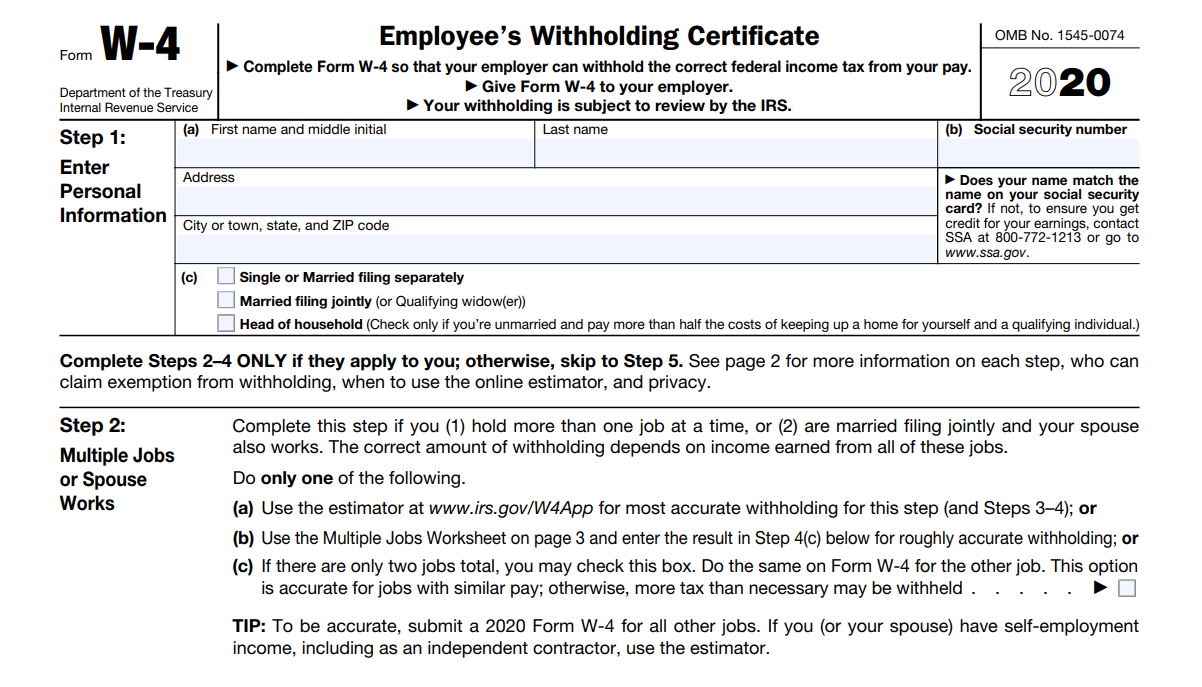

For employers, it’s important to stay up-to-date with any changes to the W-4 form. This blog post outlines the new form W-4 and provides essential information that employers need to know when it comes to accurately handling employee tax withholding.

For employers, it’s important to stay up-to-date with any changes to the W-4 form. This blog post outlines the new form W-4 and provides essential information that employers need to know when it comes to accurately handling employee tax withholding.

irs-taxes-w4-form-2020 - Alloy Silverstein

Alloy Silverstein offers insights into the 2020 version of the W-4 form and the IRS tax guidelines associated with it. Understanding how this particular version works can provide helpful context when filling out future versions of the W-4 form.

Alloy Silverstein offers insights into the 2020 version of the W-4 form and the IRS tax guidelines associated with it. Understanding how this particular version works can provide helpful context when filling out future versions of the W-4 form.

In conclusion, having access to printable versions of the W-4 form can greatly simplify the tax filing process for employees and employers alike. Whether you prefer filling out physical copies or utilizing online platforms for electronic completion, these resources ensure that accurate tax withholding information is provided to employers and the IRS. Remember to consult the specific guidelines and instructions associated with each year’s W-4 form to ensure compliance and avoid any discrepancies in tax withholding. By staying informed and properly completing the W-4 form, you can navigate the tax season with confidence.