As we navigate the world of taxes and financial responsibilities, it’s essential for small business owners to familiarize themselves with Form 1099-MISC. This important document is used to report various types of income received throughout the year. While it may seem overwhelming at first, I’m here to break it down for you and provide you with some resources that can make the process a little easier.

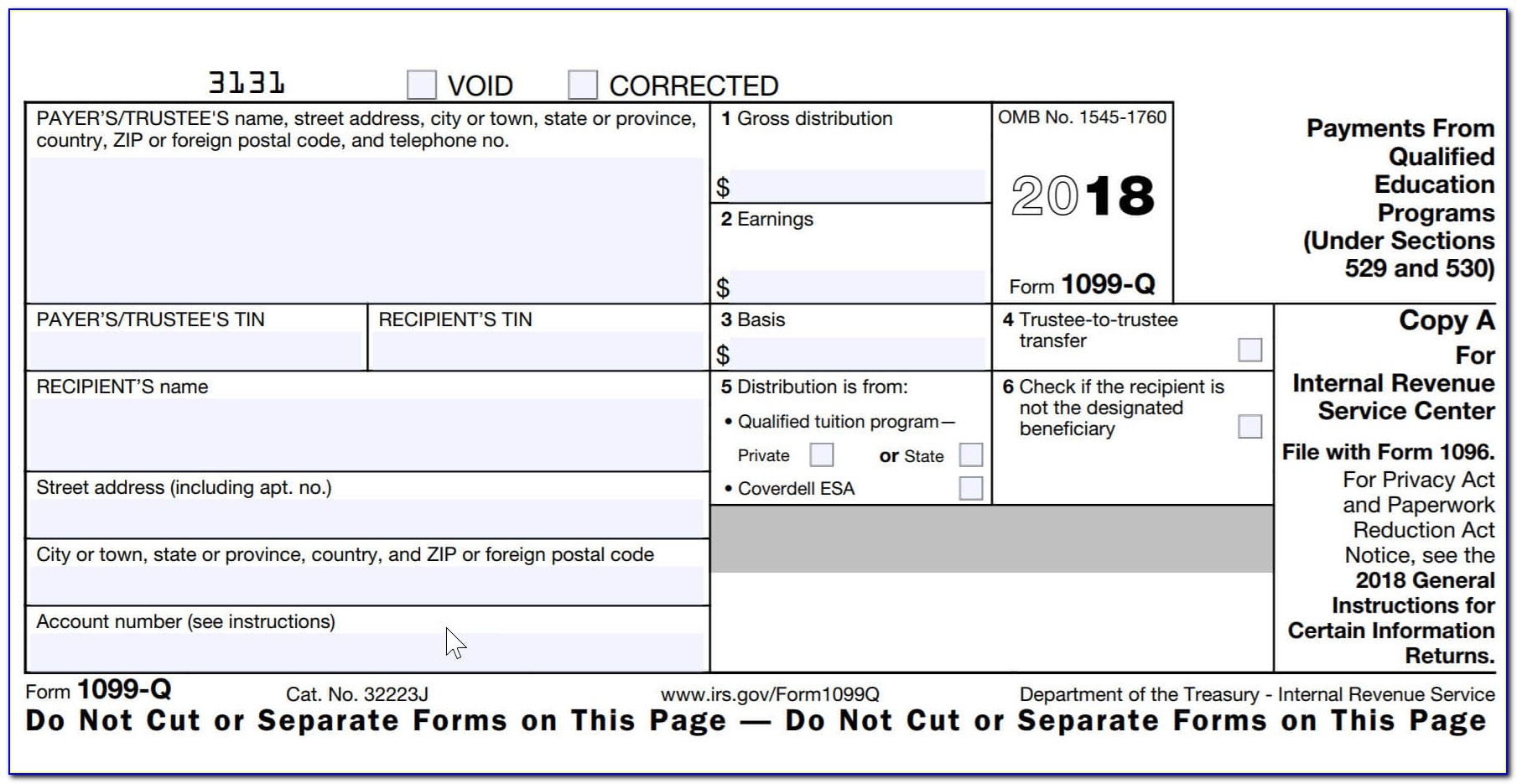

Free Printable 1099 Misc Forms

Let’s start with a handy resource - Free Printable 1099 Misc Forms. This website offers you the opportunity to generate and print your own 1099-MISC forms for free. It saves you the hassle of having to buy physical forms and allows you to fill them out conveniently online. This can be a great option for those looking to save time and money while ensuring that all the necessary information is included.

Let’s start with a handy resource - Free Printable 1099 Misc Forms. This website offers you the opportunity to generate and print your own 1099-MISC forms for free. It saves you the hassle of having to buy physical forms and allows you to fill them out conveniently online. This can be a great option for those looking to save time and money while ensuring that all the necessary information is included.

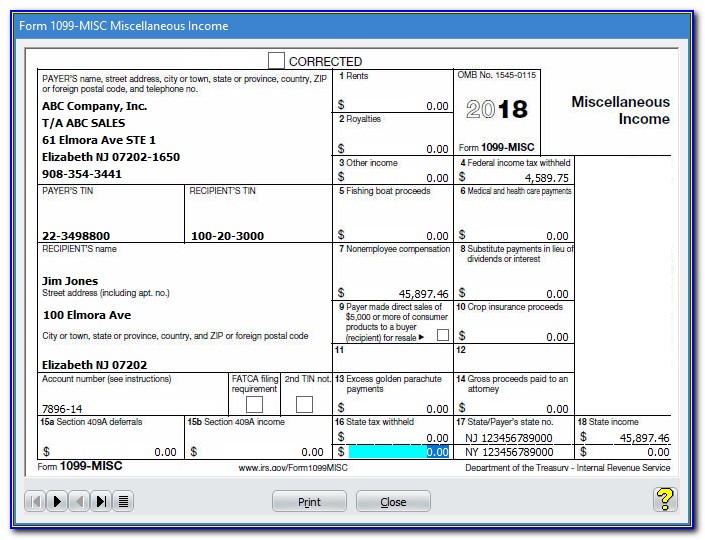

E-File 1099 - File Form 1099 Online

If you prefer to file your 1099 forms online, ExpressIRSForms.com offers a user-friendly platform to e-file your Form 1099. This can be a more efficient and streamlined process, providing you with peace of mind knowing that your forms are filed accurately and on time.

If you prefer to file your 1099 forms online, ExpressIRSForms.com offers a user-friendly platform to e-file your Form 1099. This can be a more efficient and streamlined process, providing you with peace of mind knowing that your forms are filed accurately and on time.

Generate Printable W2 Form Online

Just when you thought it couldn’t get any better, Stubcreator offers a convenient online tool to generate printable W2 forms. While W2 forms are not the same as 1099 forms, it’s crucial to keep track of both as a small business owner, especially if you have employees. Stubcreator simplifies the process of generating accurate W2 forms for your employees, ensuring compliance with IRS regulations.

Just when you thought it couldn’t get any better, Stubcreator offers a convenient online tool to generate printable W2 forms. While W2 forms are not the same as 1099 forms, it’s crucial to keep track of both as a small business owner, especially if you have employees. Stubcreator simplifies the process of generating accurate W2 forms for your employees, ensuring compliance with IRS regulations.

Fast Answers About 1099 Forms for Independent Workers

Ever wondered about the essential details of 1099 forms for independent workers? Baytek Blog has got you covered. They provide fast and easily digestible answers to common questions about 1099 forms. Whether you’re a freelancer or contractor, understanding the ins and outs of these forms is crucial for tax reporting purposes.

Ever wondered about the essential details of 1099 forms for independent workers? Baytek Blog has got you covered. They provide fast and easily digestible answers to common questions about 1099 forms. Whether you’re a freelancer or contractor, understanding the ins and outs of these forms is crucial for tax reporting purposes.

What Is Form 1099-MISC? When Do I Need to File a 1099-MISC?

If you’re unsure about the purpose and timing of filing 1099-MISC, Gusto has an informative guide that answers all your questions. They explain the situations in which you need to file a 1099-MISC, who should receive this form, and the deadlines associated with it. This knowledge is crucial to ensure you’re meeting your tax obligations accurately and in a timely manner.

If you’re unsure about the purpose and timing of filing 1099-MISC, Gusto has an informative guide that answers all your questions. They explain the situations in which you need to file a 1099-MISC, who should receive this form, and the deadlines associated with it. This knowledge is crucial to ensure you’re meeting your tax obligations accurately and in a timely manner.

6 Must-Know Basics: Form 1099-MISC for Independent Contractors

For independent contractors, understanding the basics of Form 1099-MISC is crucial. Bonsai has created a comprehensive guide that covers everything you need to know. From differentiating between employees and independent contractors to deciphering the various boxes on the form, this resource will provide you with the knowledge necessary to navigate the world of 1099-MISC reporting with confidence.

For independent contractors, understanding the basics of Form 1099-MISC is crucial. Bonsai has created a comprehensive guide that covers everything you need to know. From differentiating between employees and independent contractors to deciphering the various boxes on the form, this resource will provide you with the knowledge necessary to navigate the world of 1099-MISC reporting with confidence.

Ficial 1099 Form Printable 2016 Bing Images Design

Viralcovert offers a printable 1099 form for the year 2016. While the design may be a bit outdated, the form itself is still valid. This can be helpful if you have any outstanding 2016 forms that need to be filled out and filed.

Viralcovert offers a printable 1099 form for the year 2016. While the design may be a bit outdated, the form itself is still valid. This can be helpful if you have any outstanding 2016 forms that need to be filled out and filed.

1099 Misc Fillable Form Free

Lastly, if you prefer to fill out your 1099 forms digitally, Amulette offers a fillable form for free. This allows you to enter the necessary information directly into the form on your computer, eliminating the need for handwriting or printing multiple copies.

Lastly, if you prefer to fill out your 1099 forms digitally, Amulette offers a fillable form for free. This allows you to enter the necessary information directly into the form on your computer, eliminating the need for handwriting or printing multiple copies.

In conclusion, understanding and completing Form 1099-MISC is an essential responsibility for small business owners and independent contractors. These resources can help simplify the process, whether you prefer physical forms, online filing, or digital fillable forms. Remember to consult with a tax professional if you have any specific questions or concerns, as they can provide personalized guidance based on your individual circumstances.